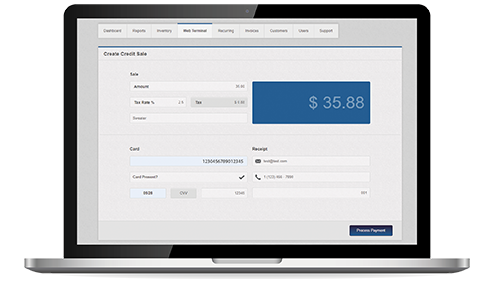

Payments On A Computer

Apriva’s Virtual Terminal allows you to securely accept transactions, any time you need to, anywhere you can access the internet. No app download needed. No POS device needed. Perfect for phone or mail-in orders, or as a reliable backup payment solution.

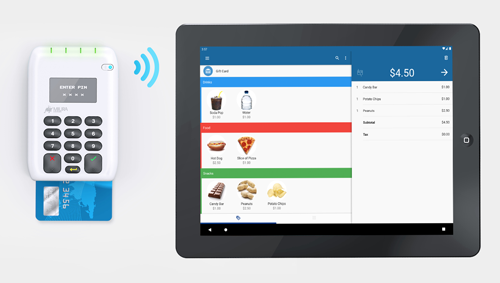

Payments Behind The Counter

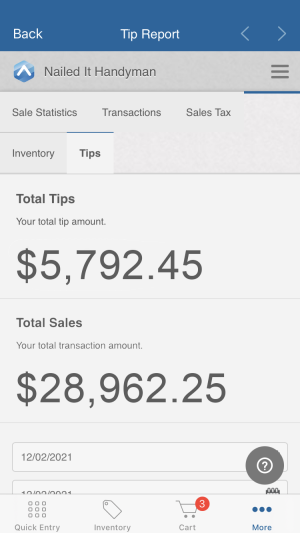

AprivaPay Register is built for any business that needs a countertop payment solutions where they can manage tips, see dynamic reporting, and more.

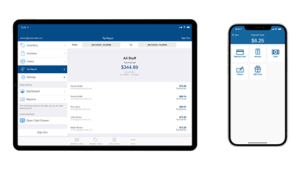

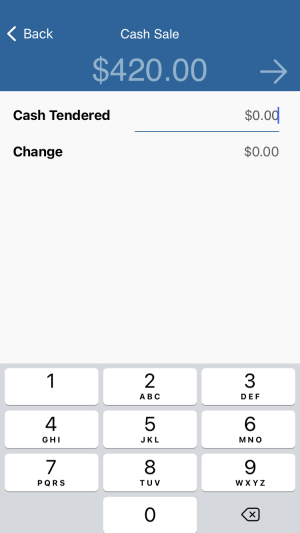

Payments On The Go

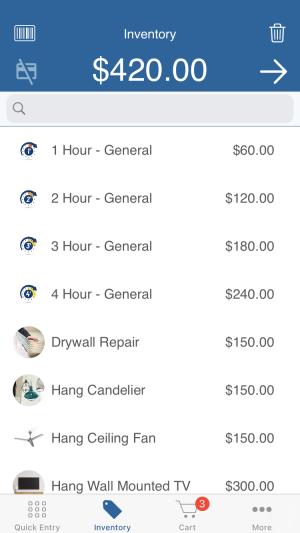

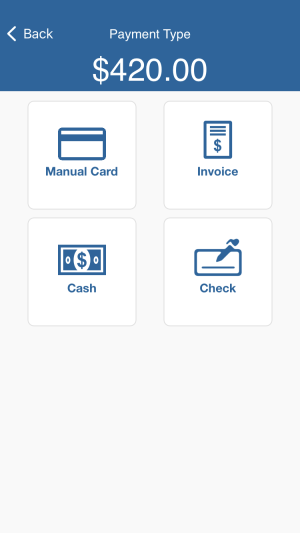

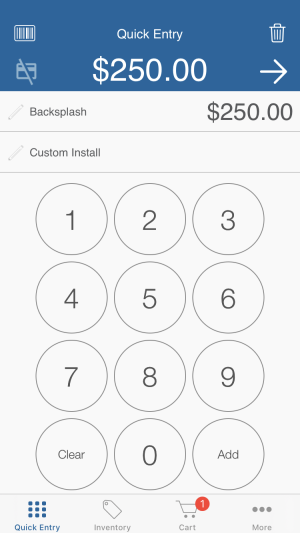

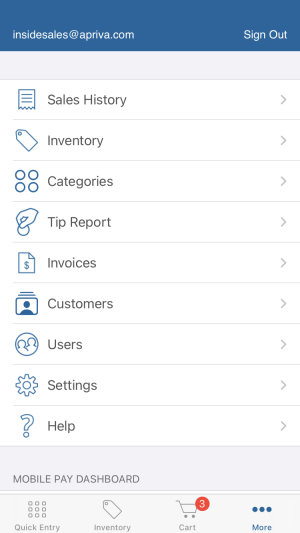

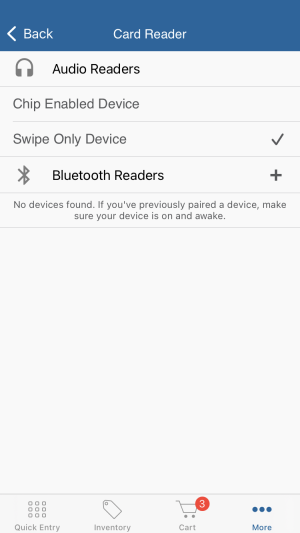

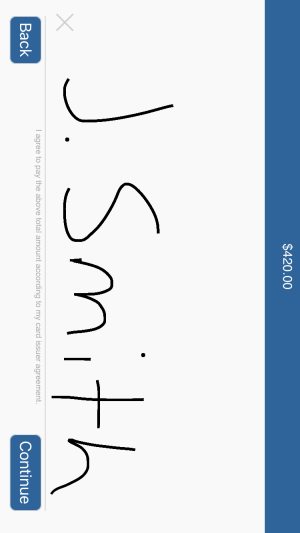

AprivaPay Mobile is the affordable, fully mobile payment app that lets you run your business from your Apple, Android, or Amazon smartphone or tablet. Use alone or pair with a payment device, accept any way your customers want to pay.

Payments on a Handheld mPOS Device

Introducing AprivaPay on PAX. The full power of the AprivaPay payment platform in one simple traditional payment device. Use in any environment, any use case, receipt printer included. Available on the PAX A920/A920Pro and A80.

High Volume Retail

Apriva’s payment gateway can even support payment terminals for multilane check-out lines! Customers can swipe, dip, or tap any way they want pay quickly, securely, and at-scale.

All Powered By a Single Dashboard

Merchant Studio is a web-accessible application that centralizes and consolidates reporting and management tools across multiple locations, devices, and tools. Have a register setup behind the counter, a handheld mPOS on the floor, and use mobile when line busting? It’s all here.

Tired of Paying For Features You Don't Use?

Unlike our four-leaf and quadrangle friends who make you pay for hundreds of features you probably don’t need, we give you the features and functionality you need at a price point you can afford. Like these:

- Accept a variety of payments, from credit and debit and mobile wallets, to subscriptions, gift cards, campus cards, and more.

- Powerful reporting dashboard

- Mobile and register point of sale.

- Print order notes and receipts.

- Comprehensive tip management.

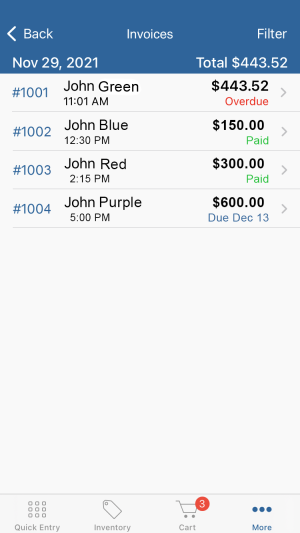

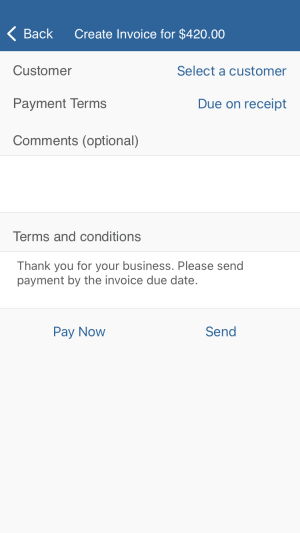

- Generate digital invoices via text or email

- Digital invoicing via SMS or email

- Language and currency localization.

- APIs and SDKs for integration needs

- Extensive hardware bundles, EMV certified devices, and certified peripherals

- 24/7 US-based customer service

- Highest level of protection from fraud

Comprehensive Bundles for Any Business

Regardless of what type of business you’re running, from a retail or restaurant location to a home service business, we give you the functionality you need to affordably and quickly accept payments. Choose from one of our easy bundles, or mix and match equipment. Are you an ISO or re-seller? Click on any of the bundles below, or click here for custom solutions to meet your merchants needs.

Mobile Lite

• Web-Based Virtual Terminal

• Perfect For Backup or Linebusting

• No Payment Hardware Needed

• Web-based Virtual Terminal, no app needed

• AprivaPay activation, including:

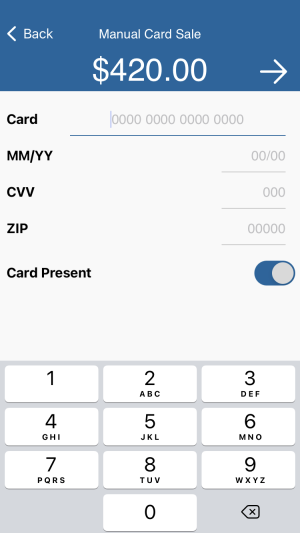

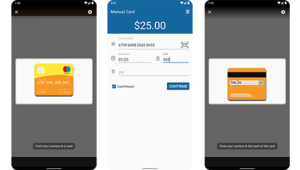

- In-app OCR Card Scan or manual card entry

- Secure transactions over the phone

- Generate digital invoices on the go

- Manage subscription payments

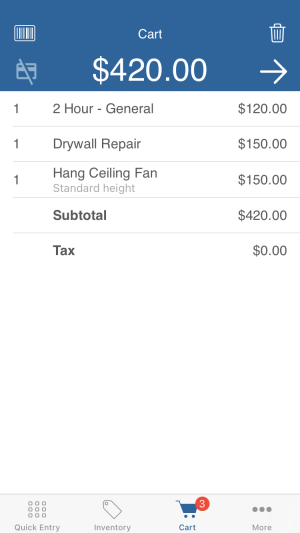

Mobile Plus

• AprivaPay Mobile Payment App on a Phone or Tablet

• Pairs With Card Reader + Printer

• Accept Any Payment on the Go

• Mobile Bluetooth Printer (Optional)

• AprivaPay activation, includes everything that comes with Mobile Lite, plus:

- Swipe, Chip, or tap credit or debit card payments, or type or scan them in.

- Moible Wallet (NFC) acceptance

- Save with Cash feature

- Advanced Inventory Management

Handheld mPOS

• AprivaPay Mobile Payment App Built-in to a Handheld mPOS

• Touchscreen + Built-in Printer

• AprivaPay activation, including:

- Ability to generate digital invoices

- Manage subscription payments

- Access to Merchant Studio

- Swipe, chip, or tap credit and debit cards

Countertop Register Solutions

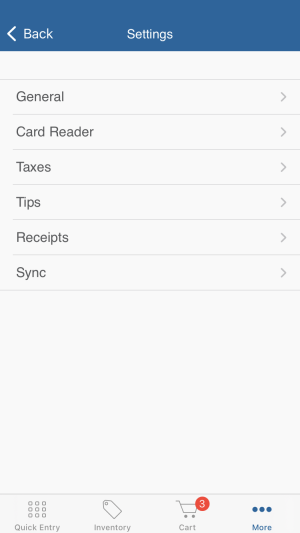

From affordable setups that rely on EMV certified Bluetooth card readers and tablets on a flip stand, to all-in-one registers including the EMV certified PAX e800, we have a countertop solution for you! Choose one of the bundles below, or mix and match equipment to get exactly what you need.

AprivaPay activation includes:

- Accept any payment type

- Integrate with cash drawers, printers, and card readers

- Advanced tip management

- Print order notes and receipts

- Dynamic register reporting

- Generate digital invoices

- Save with Cash feature

- Advanced inventory management

- Access to web-based Merchant Studio

Want to see more options? Click here to view out list of EMV certified devices, or click here to see additional supported hardware.

Easy to Set up and Use

AprivaPay AnyWay products and compatible hardware are fast and easy to set up, creating a seamless experience. It’s just as easy as setting up any other app or Bluetooth device.

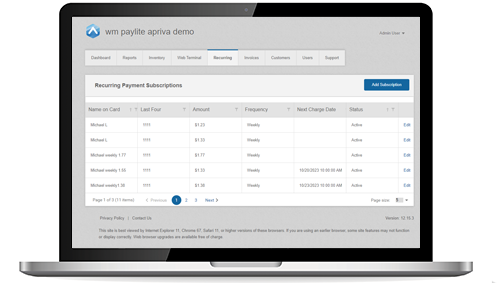

Powerful Web-Based Dashboard with Everything You Need

- Virtual terminal transaction capabilities, great for taking payments securely over the phone.

- Refund capabilities for mobile, invoice, subscription, or virtual terminal transactions.

- Advanced reporting dashboard.

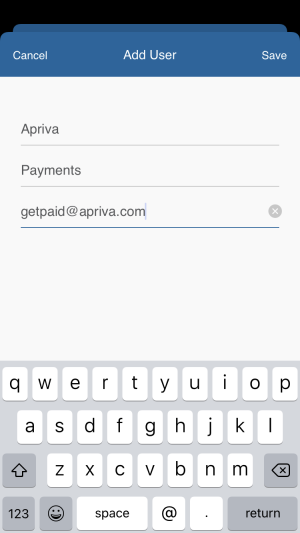

- Admin-level user creation and management.

- Transaction reports by user.

- Cloud inventory management.

- Exportable enterprise-level XML reports

- Integrated customer support.

- Device management.

- Generate digital invoices and send via email or text.

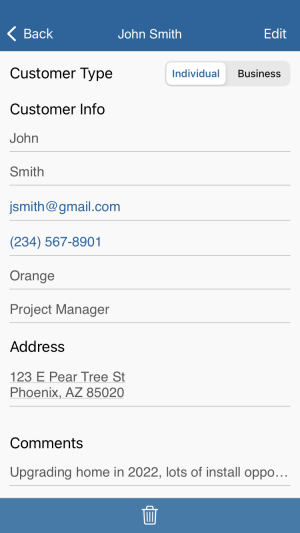

Accept Any Way Your Customers Want to Pay

Credit + Debit

Type, Scan, Swipe, Dip, or Tap credit and debit cards wherever your business takes you!

Mobile Wallets

Accept NFC Payments such as ApplePay®, Google Pay®, and Samsung Pay®.

Campus Cards

Accept campus cards, military ID cards, employee ID cards, mobile campus credentials, and other closed-loop payments.

Virtual Terminal

No payment device? No problem. Scan cards using OCR technology or manually enter card information into your AprivaPay app. Merchant Studio web companion can also be used to key in payments, great for secure phone orders.

Generate Invoices

Send digital invoices via SMS or email directly from your AprivaPay app or Merchant Studio, great for curbside pickup, order-ahead, or generating invoices on-location.

Card Tokenization

Our Card on File tokenization and secure “card on file” capabilities allow customers to not have to show their cards at all, and allows merchants to accept card not present payment methods such as biometrics, QR codes, stored subscription information, and more.

Highest Level of Protection From Fraud

Apriva is a PCI Level 1 Service provider, independently validated by VISA®, MasterCard®, American Express®, and the Payment Card Industry Security Standards Council™ (PCI-SSC). We are one of the only P2PE Certified Gateways in the industry. Period. Others claim P2PE, but they are “self-assessed”. We are certified by a PCI Council Auditor every 2 years. This means the odds of you being responsible for a data breach are as low as they can possibly be.

Professional Payment Services Tailored to Your Needs

Payment Services

Leverage Apriva’s payment services to meet your payment needs, from white-labeling our mobile payment apps, choosing from multiple payment acceptance methods and devices, creating custom reporting, and more.

Customer Care

Apriva provides a 24/7 live US-based customer service center for merchants and resellers. Dedicated account management and sales liaisons provide further support as your business grows with Apriva.

Integration Services

Part of Apriva’s payment services include integration services, which support Independent Software Vendors (ISVs), software developers, and app developers through the programmatic integration of secure payments.

Experience a Better Level of Service.

Contact us Today!

At Apriva, we treat you like a human, giving you 24/7 access to live US-based sales and customer support professionals. That’s the way we believe business should operate. So go ahead! Click the button below, give us a call at 877-435-3141, or email us at pos@apriva.com.